Publish Date

2021-09-14

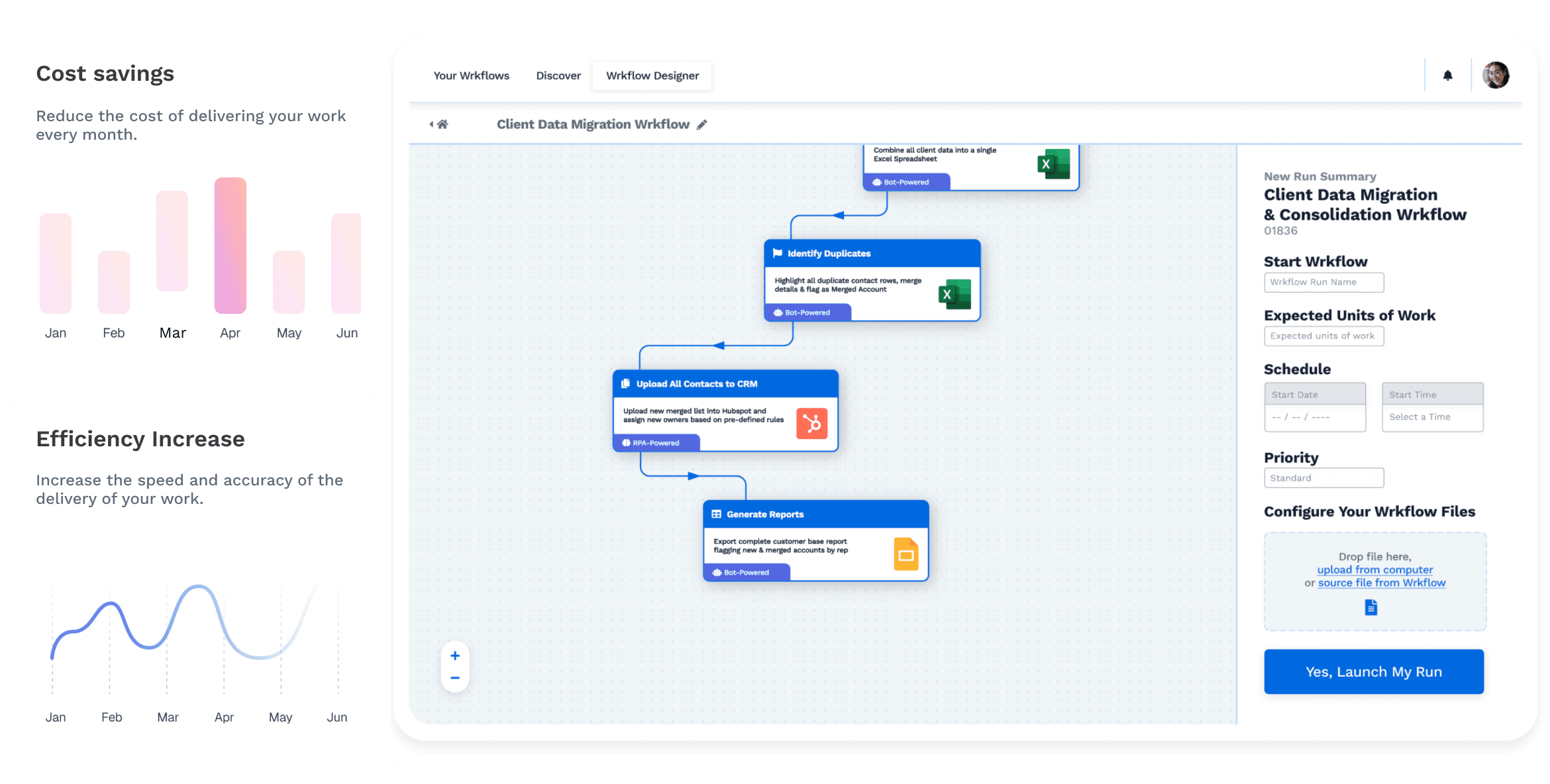

Introduction to Financial Automation

Major actors in the financial services industry are increasingly turning to automation to improve their business processes. In fact, a McKinsey survey of 800 executives found that 88% of finance and insurance executives surveyed said that they increased the implementation of automation and AI since the COVID-19 pandemic started in 2020.

With financial services automation, energy can be redirected from repetitive and manual data entry and administrative tasks toward analysis and planning for areas of future growth. Besides, wouldn't you agree that your company's time is better spent making important financial decisions, finding new ways to save on budget, and seeking out new business partnership opportunities rather than getting bogged down with time-consuming, repetitive work? Financial automation makes these endeavours all the more achievable by supporting them with reliable, up-to-date, and accurate data.

We share how finance automation is imperative to the future of financial services, banking, and insurance—and how the Wrk platform can help you achieve it.

What is Finance Automation?

In basic terms, finance automation is the process of using technology to complete financial tasks with minimal or no human intervention.

According to Gartner, finance automation "integrates machine learning and artificial intelligence for use in areas such as financial analysis, payroll administration, invoice automation, collections actions, and preparing financial statements."

That is not to say that automated finance solutions are intended to replace all human activity. Instead, automation offers those in the financial services sector an opportunity to bolster some of their biggest resources: their data and their teams' invaluable skill sets.

Financial automation frees up time so that energy can be dedicated to meaningful, analytical tasks that can help ensure your company is meeting its KPIs while skillfully managing evolving and variable customer expectations. These higher-value tasks are often future-oriented, and they are key to providing financial services that exceed customer expectations and reduce operational costs for years to come.

What's more, implementing automation doesn't mean your company needs to reinvent the wheel. The finance, insurance, and banking sectors are able to supplement pre-existing processes with flexible automation solutions like Wrk. As we'll explain below, identifying highly repetitive, time-consuming tasks is the gateway to employing these automation solutions effectively. At the end of the day, financial automation is a shift away from the costly errors that manual data entry is prone to, and a shift toward a higher degree of transparency and accuracy, building trust between your company and its customers.

Why Choose Finance Automation?

10%-25% of an employee's time is spent on repetitive computer tasks during their workday, despite the fact that many of these standard rules-based processes can be almost entirely automated. There's an established history of human errors plaguing financial reporting. Whether an employee has made a minor error in data entry or completely disregarded an important policy, these human errors are costly yet avoidable. Financial automation is a long-term solution to these age-old pitfalls.

The reality is that repetitive, rule-based tasks don't require human input. So, it's better to free up your team's time for the tasks that do.

Financial services automation gives your business a chance to get repetitive work out of the way early and focus on development opportunities. This allows your team to make sure those important but time-consuming tasks are accomplished—with less effort and fewer errors. It can also be a major relief for companies that have been habitually bogged down by an endless stream of paperwork and receipts.

Human error doesn't just equate to costly setbacks for your company, but it can sacrifice the integrity of your data. Data that's riddled with errors can negatively impact a company's reputation and relationship with its customers, as well as hurting overall business operations. Financial automation improves the quality of data that the finance sector will use to inform their decisions, so those high-value tasks your team is working on are supported by the most accurate data available.

However, the most valuable result of financial automation might simply be the newfound ability for your company's talent to spend time analyzing rich and accurate data, being able to prepare for the future, and continuing to build relationships with clients.

How You Can Use Finance Automation Today

For finance, banking, and insurance companies, the time saved with automation can be directed toward future-focused ideation, analytics, and planning that will lead to improvements for years to come. Here, we break down some concrete ways financial services automation can serve your business' specific needs.

Automating Insurance Claim Processing

Valuable opportunities for customer-focused human-to-human contact can fall through the cracks if energy is tied up elsewhere.

Automation can help reduce fraud and identify duplicate claims. Automated data annotation and labelling allows the right information to reach the right people faster, contributing to a positive claims management process. When claims are addressed faster, issues can be identified and followed up sooner.

Our Data Annotation Wrkflow can flag potentially fraudulent claims based on a set of rules, classify different claims and send them on to the correct department, while highlighting any key information from the submitted documents.

Financial Reporting Automation

The automation of financial reporting clears the way for analysts to work closely with the data they have to inform accurate financial forecasts and create plans for the future. Bridging the gap between receiving a document and having its information recorded into a database leaves less room for error.

Tasks like tabulating data, organizing spreadsheets, and arranging invoices can be incorporated into your financial reporting automation workflow so that no information is missing from financial reports. Any duplicate data can be identified and removed promptly, before disrupting the report.

Invoicing Automation

Sorting through invoices by hand and directing them to the right person to complete your financial records is a time-consuming and tedious process. In an accounting department, the average employee can process up to 906 invoices per month: this breaks down to 42 per day, or just 5 invoices per hour. The good news is that nearly all steps of the invoicing process can be automated, making it possible to accomplish significantly more in less time.

An automated workflow can do the sorting and labelling for you. You can also set up your workflow to send an invoice to the right folder or to an email recipient based on a simple set of rules.

Automated data annotation also makes it possible for information to be extracted accurately from scanned invoices to be used in the labelling process. This means paperwork can be stored away quickly and essentially, digital records can sort themselves. And these processes can be done simultaneously.

Our Accounts Payable, Receivable & Invoicing Wrkflow can help you with cash-flow management, allowing your business to operate, forecast, and scale.

Expense and Budget Management

According to a 2019 report, about 43% of organizations are still managing expense reporting manually. In addition, nearly half (46%) of organizations don't keep track of the cost to process expense reports. As it turns out, the cost can be a large one to bear for those in the financial sector.

Businesses have a lot to gain by investing in a dedicated expense management system. Early adopters of a dedicated expense management system are already seeing returns on the investment.

An automated workflow can make rule-based decisions for you: approve or decline requests based on pre-existing budget parameters, create a system to submit, track, and record reimbursable expenses.

Tax Preparation

When companies automate their tax preparation processes, they're able to navigate continuously evolving tax policies without sacrificing their returns.

Specifically, the use of a tax preparation Wrkflow can help companies seamlessly integrate this automated finance solution into their workflow, making preparation for tax season efficient and simple.

How Do You Get Started with Finance Automation?

Automation is making the complex world of finance more simple by breaking down large, cumbersome tasks into obtainable opportunities.

We believe that when it comes to automating any business process, you need to learn to walk before you learn to run. While it may be tempting to automate every task right away, starting small is key to success. The best place to begin is by identifying one task that is taking your team a lot of time. Adopting automation as a solution to an existing problem will be able to give you an idea of how to reinforce current financial services processes to help scale your business and meet growing customer demands. From there, the world is your oyster.

Find out what this might look like for your company by piloting one of Wrk's Wrkflows today.

Featured Image

Start Automating with Wrk

Kickstart your automation journey with the Wrk all-in-one automation platform