Date de publication

2023-10-16

Cash flow is the lifeblood that keeps operations running smoothly. Managing cash flow effectively is essential for sustaining and accelerating growth. It ensures a business can meet its financial obligations, seize new opportunities, and weather economic storms. This blog will explore the strategies and best practices for optimizing cash flow management to drive business growth.

Understanding Cash Flow

Before we explore strategies for optimizing cash flow, it's essential to understand what cash flow is clearly. Cash flow represents the movement of money in and out of your business. It can be categorized into two main components: cash inflows and outflows.

Cash Inflows

Cash inflows are the funds that come into your business. They typically include:

Sales Revenue: This is most businesses' primary cash source. It consists of the money you receive from selling products or services.

Investments: Funds injected into your business from investors or shareholders.

Loans: Money acquired through loans, which can be from banks, financial institutions, or other sources.

Cash Outflows

Cash outflows are the funds that leave your business. They comprise:

Operating Expenses: Costs of running your business, including rent, utilities, salaries, and other day-to-day expenditures.

Loan Repayments: Regular payments to service loans, including principal and interest.

Taxes: Payments to government authorities, such as income and sales taxes.

Challenges in Cash Flow Management

Several challenges can impede effective cash flow management. Recognizing these challenges is the first step in addressing them and optimizing cash flow for business growth.

Seasonal Fluctuations: Many businesses experience seasonal fluctuations in cash flow. For example, a retailer may have a significant cash inflow during the holiday season but slower sales during the rest of the year. Managing cash flow during these variations can be challenging.

Unpredictable Expenses: Unexpected expenses, such as equipment breakdowns, legal issues, or a sudden need for major repairs, can strain your cash flow.

Slow-Paying Customers: If customers take a long time to pay their invoices, it can create cash flow problems. This is particularly common in B2B industries where payment terms are extended.

Overstocked Inventory: Maintaining excessive inventory ties up cash that could be used for other critical expenses. It can also lead to holding costs and obsolescence.

Strategies for Optimizing Cash Flow

Efficient Invoicing and Payment Collection:

Clear Invoicing Terms: Ensure your invoices are concise and contain specific payment terms. This helps reduce misunderstandings and accelerates the payment process.

Early Payment Discounts: Offer discounts to customers who pay invoices early. This can incentivize prompt payments and improve your cash flow.

Use of Technology: Invest in invoicing and accounting software to streamline the invoicing process and track payments more effectively.

Expense Reduction:

Identifying Unnecessary Costs: Regularly review your expenses to identify and eliminate unnecessary or redundant costs.

Negotiating with Suppliers: Negotiate better terms with your suppliers, such as extended payment terms or discounts for early payments.

Implementing Cost Control Measures: Implement cost control measures, such as energy-efficient technologies or more efficient production processes, to reduce operating costs.

Inventory Management:

Implementing Just-In-Time (JIT) Inventory: JIT inventory management minimizes excess stock by ordering only what you need when you need it. This approach can significantly reduce carrying costs.

Reducing Excess Stock: Periodically assess your inventory levels and identify slow-moving or obsolete items to free up cash.

Monitoring Inventory Turnover: Keep a close eye on your inventory turnover rate to ensure you keep up only a little capital in unsold products.

Access to Financing:

Securing a Line of Credit: Establish a line of credit with a bank or financial institution. This acts as a financial safety net during lean times.

Exploring Short-Term Loans: Consider short-term loans for specific business needs, such as expanding operations or investing in new equipment.

Attracting Investors: Attract investors or venture capital to infuse additional capital into your business for growth.

Cash Flow Forecasting:

Creating Accurate Cash Flow Projections: Develop detailed cash flow projections to anticipate your financial needs and potential shortfalls.

Preparing for Contingencies: Build a financial cushion in your cash flow projections to handle unexpected expenses or dips in revenue.

Regularly Updating Forecasts: Continuously update your cash flow forecasts to reflect actual financial performance and changing market conditions.

Monitoring and Evaluation

Optimizing cash flow is a collaborative effort. It's an ongoing process that requires vigilance and adaptation. To ensure success, implement the following monitoring and evaluation practices:

Regular Review of Cash Flow Statements: Continuously review your cash flow statements to stay informed about your current financial position.

Key Performance Indicators (KPIs): Define and track KPIs related to cash flow, such as the cash conversion cycle, working capital ratio, and days sales outstanding (DSO).

Adjusting Strategies as Needed: Be prepared to adjust your cash flow optimization strategies in response to changing circumstances, such as shifts in the market or unexpected expenses.

Final Say

Cash flow management is an indispensable aspect of running a successful business. Optimizing your cash flow allows you to seize growth opportunities, navigate economic challenges, and ensure the stability of your operations. You can drive business growth and long-term success by implementing strategies like efficient invoicing, expense reduction, inventory management, access to financing, and cash flow forecasting. Remember that cash flow management is an ongoing endeavour that demands constant attention and adaptation to changing circumstances. Your business can thrive and prosper in any economic climate with the right strategies.

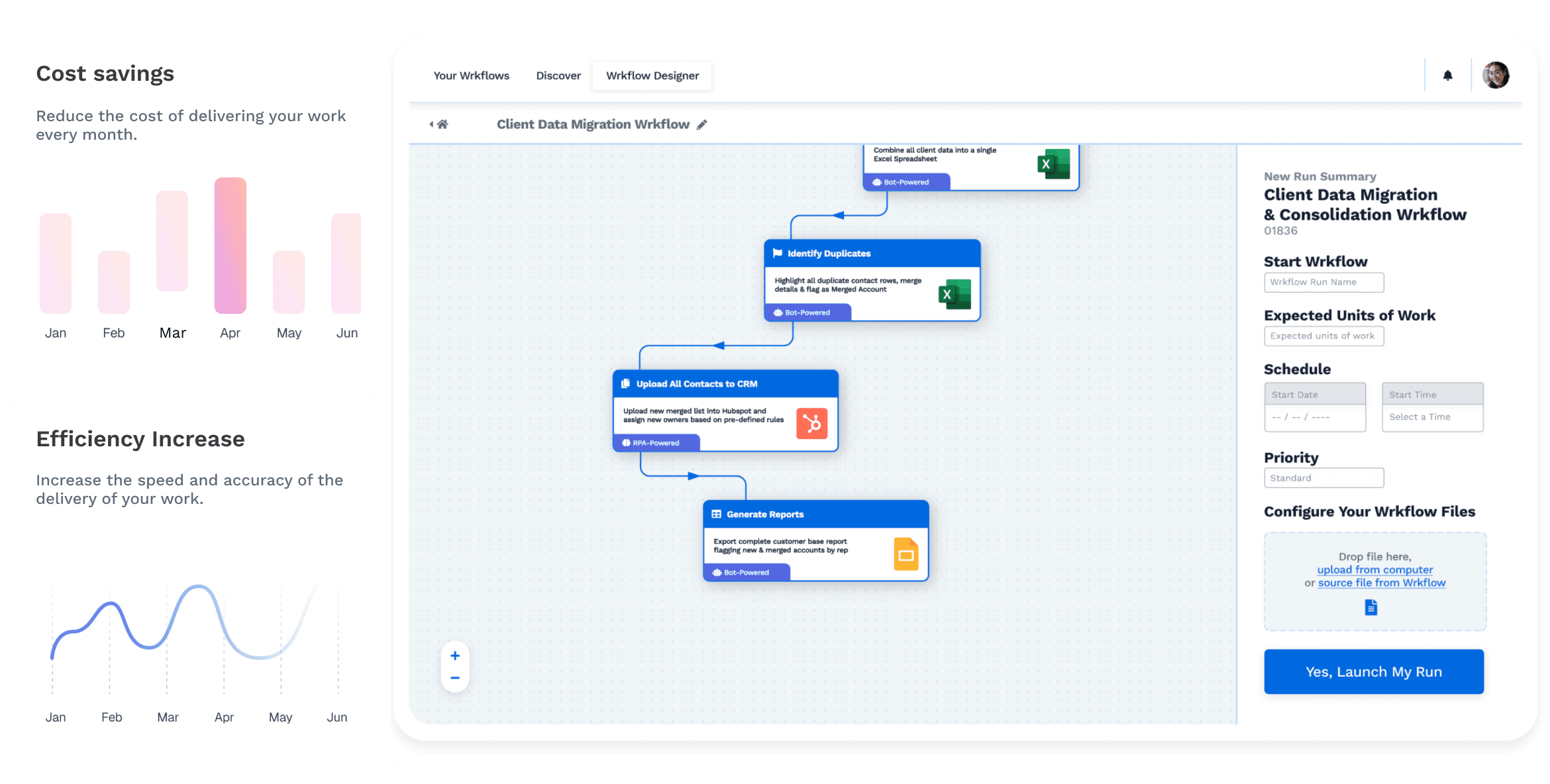

Start Automating with Wrk

Kickstart your automation journey with the Wrk all-in-one automation platform