Date de publication

2024/05/25

Efficient loan processing is crucial for financial institutions and their customers. Traditional loan processing methods often involve manual data entry, document processing, and compliance checks, leading to delays and inefficiencies. However, with the advent of technology, solutions like ServiceNow offer a powerful platform for accelerating loan processing through automation and integration. This blog delves into the challenges faced by financial institutions, how ServiceNow can accelerate loan processing, the implementation process, and future trends in this area.

Current Challenges in Loan Processing

Financial institutions need help with the loan processing process. One of the most significant issues is the reliance on manual data entry and document processing. Loan officers spend valuable time inputting customer information and verifying supporting documents, leading to delays in the approval process. Moreover, the lack of visibility and tracking makes it difficult for loan officers to monitor the progress of each application, resulting in inefficiencies and missed deadlines.

Compliance with regulatory requirements is another challenge faced by financial institutions. Financial regulations constantly evolve, requiring institutions to stay up-to-date with the latest requirements and ensure compliance throughout the loan processing lifecycle. Manual compliance checks are time-consuming and prone to errors, increasing the risk of regulatory violations and penalties.

Overview of ServiceNow

ServiceNow is a leading cloud-based platform known for its robust automation and workflow management capabilities. Initially designed for IT service management, ServiceNow has expanded its offerings to various industries, including finance. The platform provides a comprehensive solution for automating and integrating business processes, making it ideal for accelerating loan processing.

Critical features of ServiceNow relevant to loan processing include automated data collection and verification, workflow automation, and compliance and reporting capabilities. These features enable financial institutions to streamline loan processing, reduce manual effort, and improve compliance with regulatory requirements.

How ServiceNow Accelerates Loan Processing

ServiceNow accelerates loan processing through several critical mechanisms. One of the primary benefits is automated data collection and verification. ServiceNow allows customers to complete loan applications online, eliminating the need for manual data entry. Integration with credit bureaus and financial systems enables automatic customer information verification, reducing the time and effort required for manual checks.

Workflow automation is another significant advantage of using ServiceNow for loan processing. The platform automates document processing tasks, such as document collection, verification, and approval, streamlining the loan approval process. Task assignment and tracking features ensure that each application progresses through the workflow efficiently, with real-time updates and notifications for loan officers and customers.

Compliance and reporting capabilities are also essential features of ServiceNow. The platform ensures adherence to regulatory standards by automating compliance checks and documentation processes. ServiceNow generates reports and maintains records required for regulatory audits, reducing non-compliance risk and associated penalties.

Implementation Process

Implementing ServiceNow for loan processing involves several critical steps. The first step is assessing the current loan processing practices to identify pain points and areas for improvement. This assessment helps financial institutions understand their specific needs and requirements, setting the foundation for configuring ServiceNow.

Once the assessment is complete, the next step is configuring and customizing ServiceNow for loan processing. This involves integrating the platform with existing systems, such as customer relationship management (CRM) and loan origination systems (LOS), to ensure seamless data exchange. Training staff and stakeholders are also essential during this phase to ensure they are comfortable using the new system.

Testing and validation are crucial before fully rolling out the system. This step involves conducting pilot tests to identify and resolve any issues that may arise. Continuous monitoring and feedback during this phase ensure that the system functions as expected. Once validated, the system can be rolled out across the organization, with constant improvement efforts to optimize its performance.

Benefits of Accelerated Loan Processing

The benefits of using ServiceNow for loan processing are manifold. Faster approval times are one of the most significant advantages. By automating data collection, verification, and document processing, ServiceNow reduces the time required to process loan applications, enabling financial institutions to approve loans more quickly and efficiently.

Another critical benefit is improved customer experience. ServiceNow's automation capabilities reduce the burden on customers by eliminating the need for manual data entry and document submission. Customers can complete loan applications online, track their progress in real-time, and receive updates and notifications throughout the process, leading to higher satisfaction rates.

Increased operational efficiency is also a significant advantage of using ServiceNow for loan processing. The platform streamlines workflows, reduces manual effort, and improves coordination between departments, enabling financial institutions to process more loans with fewer resources. This efficiency translates into cost savings and better resource allocation.

Better compliance and risk management are additional benefits of using ServiceNow for loan processing. The platform automates compliance checks and documentation processes, ensuring financial institutions meet regulatory requirements throughout the loan processing lifecycle. This reduces the risk of regulatory violations and associated penalties, safeguarding the institution's reputation and economic health.

Potential Challenges and Solutions

While the benefits of using ServiceNow for loan processing are clear, potential challenges must be addressed. Resistance to change is a common issue when implementing new technology. Involving staff in the planning and training is essential to overcome this, ensuring they understand the benefits and are comfortable using the new system.

Technical integration issues can also arise, particularly when integrating ServiceNow with existing systems. Working with experienced implementation partners and conducting thorough testing can help mitigate these challenges. Ensuring data security and privacy is another critical concern. ServiceNow adheres to stringent security standards, but financial institutions must also implement best practices to safeguard customer data.

Future Trends and Innovations

The future of loan processing with ServiceNow is promising, with several exciting trends and innovations. AI and machine learning are poised to play a significant role in further optimizing loan processing workflows, and predictive analytics can help financial institutions assess credit risk.

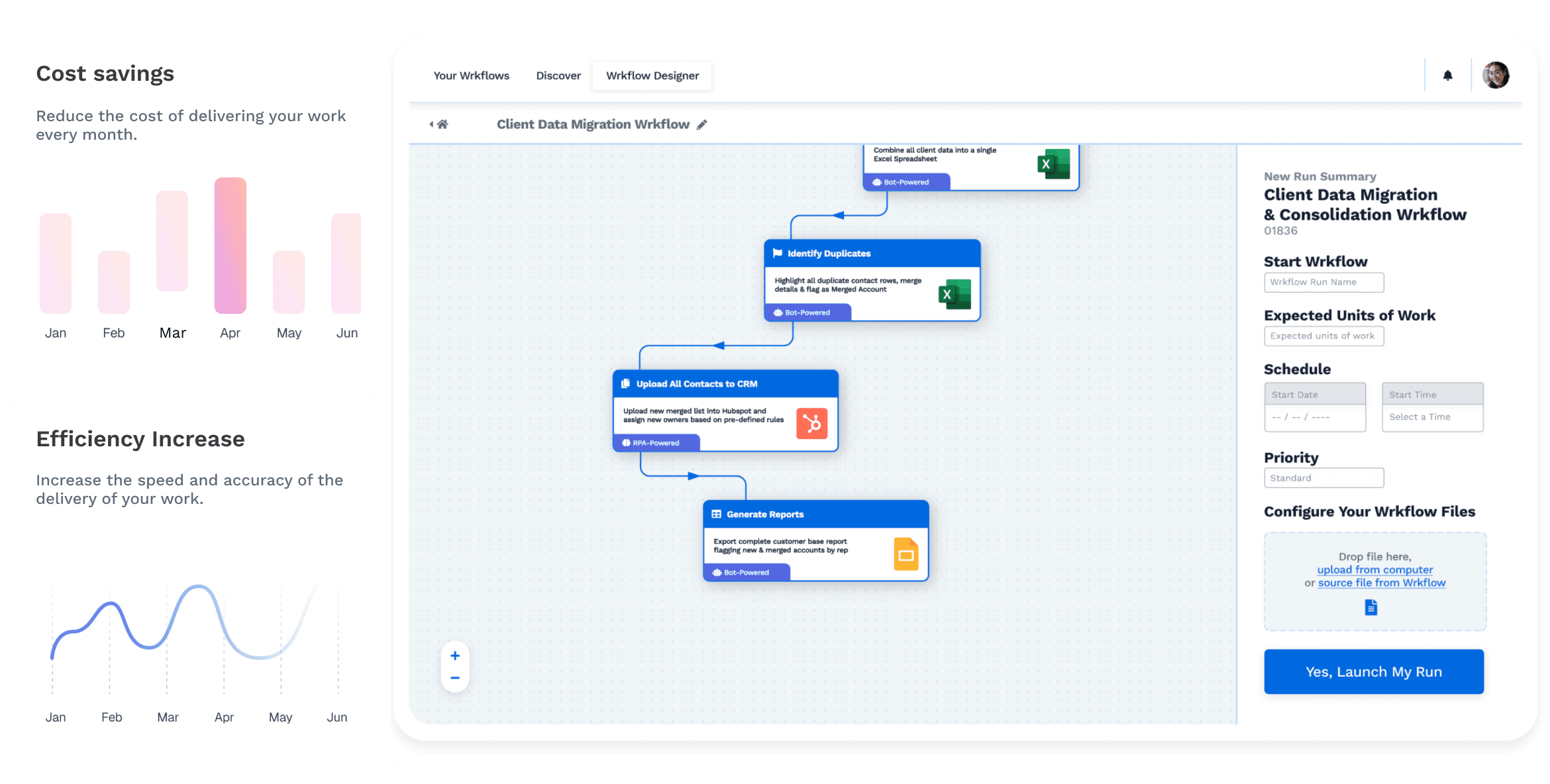

Start Automating with Wrk

Kickstart your automation journey with the Wrk all-in-one automation platform