Date de publication

2024-02-20

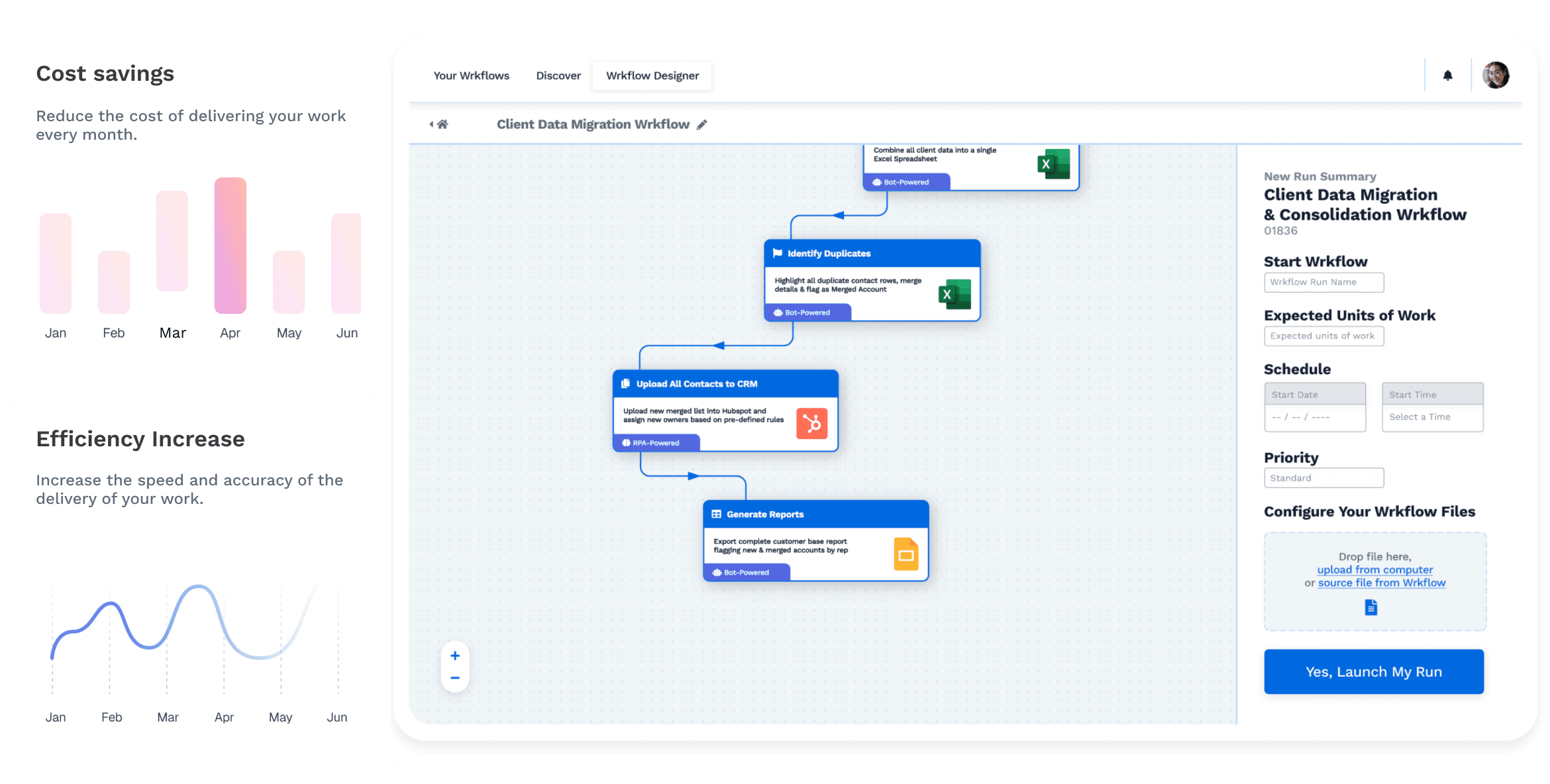

Digital transformation has emerged as a crucial driver of operational efficiency and competitiveness. By leveraging digital technologies and innovative strategies, insurance companies can streamline their operations, enhance customer experiences, and stay ahead of the curve in a rapidly changing market. In this blog, we will explore the transformative impact of digital transformation on insurance operations, focusing on critical areas such as policy administration, claims processing, customer service, and engagement.

Understanding Digital Transformation in Insurance

Digital transformation in the insurance industry involves strategically adopting digital technologies to revolutionize traditional processes and operations. This encompasses many initiatives, including digitizing paperwork, automating manual tasks, integrating data analytics for decision-making, and enhancing customer interactions through digital channels. The primary objectives of digital transformation in insurance are to improve operational efficiency, reduce costs, strengthen risk management, and deliver superior customer experiences.

Critical Areas for Optimizing Operations Through Digital Transformation

Policy Administration and Underwriting:

Digital transformation enables insurance companies to streamline policy administration and underwriting processes through automation and data integration. Insurers can reduce processing times, minimize errors, and improve overall efficiency by digitizing paperwork and automating routine tasks such as policy issuance and renewal. Additionally, the integration of data analytics allows insurers to assess risk more accurately, price policies competitively, and make data-driven underwriting decisions.

Claims Processing and Management:

Claims processing is another critical area where digital transformation can drive significant efficiency and customer satisfaction improvements. By implementing digital channels for claims intake and processing, insurers can simplify the claims submission process, reduce paperwork, and accelerate claims settlement times. Furthermore, adopting predictive analytics enables insurers to detect fraudulent claims more effectively, assess claims accurately, and expedite the resolution process, ultimately enhancing the overall claims experience for policyholders.

Customer Service and Engagement:

Digital transformation empowers insurance companies to deliver superior customer service and engagement through personalized digital experiences. By implementing self-service portals and mobile apps, insurers can provide policyholders convenient access to their policies, claims status, and other relevant information. Moreover, data-driven insights enable insurers to personalize customer interactions, anticipate their needs, and offer tailored products and services, strengthening customer relationships and increasing retention rates.

Challenges and Considerations in Digital Transformation for Insurance Operations

While digital transformation offers numerous benefits for insurance operations, it also presents challenges and considerations that insurers must address. Legacy systems and infrastructure, data security and privacy concerns, and regulatory compliance are critical challenges insurers may face during their digital transformation journey. However, with careful planning, strategic investments, and collaboration with experienced digital transformation partners, insurers can overcome these challenges and unlock the full potential of digital transformation.

Best Practices for Maximizing Operational Efficiency Through Digital Transformation

To maximize operational efficiency through digital transformation, insurers should adopt the following best practices:

Executive Leadership and Sponsorship: Ensure buy-in and support from executive leadership to drive digital transformation initiatives and allocate resources effectively.

Clear Communication and Stakeholder Engagement: Foster open communication and collaboration among stakeholders to ensure alignment with business objectives and address concerns proactively.

Agile and Iterative Approach to Implementation: Embrace an agile mindset and iterative approach to implementation, allowing for flexibility, adaptation, and continuous improvement throughout the transformation process.

Continuous Learning and Adaptation: Encourage a culture of continuous learning and adaptation, empowering employees to embrace change, acquire new skills, and drive innovation in insurance operations.

Future Trends and Predictions in Digital Transformation for Insurance Operations

Several trends are expected to shape the future of digital transformation in insurance operations. Integrating emerging technologies such as artificial intelligence, machine learning, and blockchain will continue to drive innovation and disruption in the industry. Additionally, there will be a greater focus on customer-centricity and personalization, with insurers leveraging data analytics and digital channels to deliver tailored products and services that meet customers' evolving needs. Furthermore, the expansion of usage-based insurance models and the rise of InsurTech startups will further accelerate digital transformation efforts in the insurance industry.

Final Say

In conclusion, digital transformation holds immense potential for optimizing operations and driving value in the insurance industry. By embracing digital technologies and innovative strategies, insurers can streamline policy administration, claims processing, and customer service operations, ultimately enhancing efficiency, reducing costs, and delivering superior experiences for policyholders. While digital transformation presents challenges and considerations, insurers can overcome these obstacles by adopting best practices, collaborating with experienced partners, and staying abreast of emerging trends and technologies. As the insurance industry evolves, digital transformation will be instrumental in shaping its future and driving sustainable growth and competitiveness.

Start Automating with Wrk

Kickstart your automation journey with the Wrk all-in-one automation platform