Publish Date

2023-10-31

Insurance agencies are undergoing a transformation fueled by technology. Insurance agency automation is at the forefront of this shift, helping streamline processes and drive better results. By leveraging automation tools and technologies, insurance agencies can not only boost their operational efficiency but also enhance customer service and data accuracy. In this blog, we'll explore the various aspects of insurance agency automation and the advantages it offers, as well as the challenges involved in its implementation and best practices for success.

Benefits of Insurance Agency Automation

Automation in insurance agencies brings forth a multitude of benefits. First and foremost, it increases efficiency and productivity. Repetitive and time-consuming tasks, such as data entry, can be automated, allowing employees to focus on more strategic and customer-centric activities. This not only saves time but also reduces the risk of human errors, leading to improved operational excellence.

Additionally, insurance agency automation significantly enhances customer service. Through automation, agencies can respond to customer inquiries and service requests more promptly. Automated follow-ups and personalized communication contribute to a better customer experience. In a highly competitive industry like insurance, this can be a game-changer, fostering client loyalty and trust.

Moreover, automation ensures enhanced data accuracy. With sensitive customer information, ensuring data security and accuracy is paramount. Automation systems are designed to minimize errors in data processing and improve data management, leading to a higher level of confidence in the information used for decision-making.

Key Components of Automation in Insurance Agencies

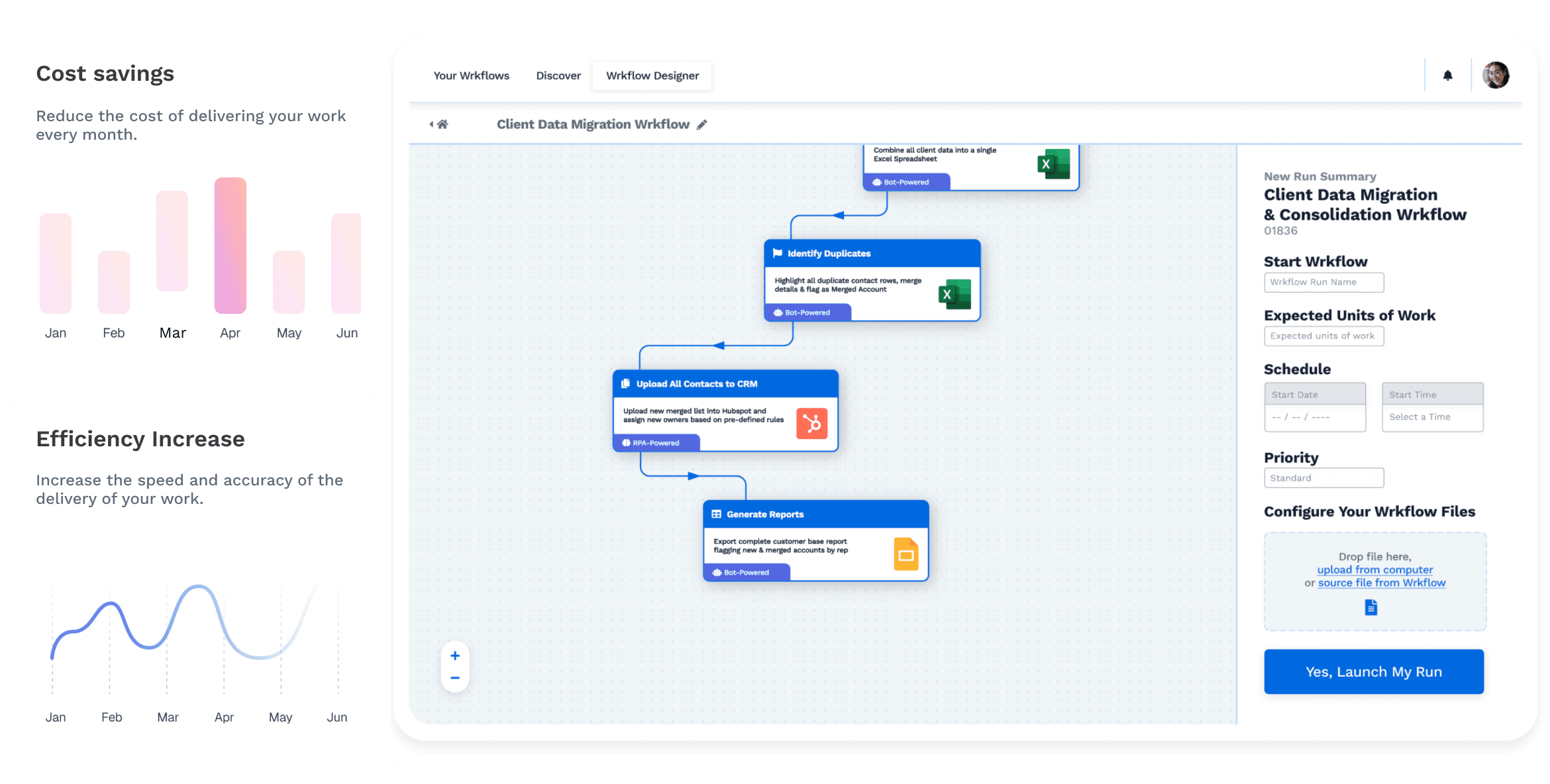

Automation in insurance agencies spans various key components, each contributing to the overall efficiency and effectiveness of operations. These components include policy management, customer relationship management (CRM), claims processing, and reporting and analytics.

Policy management automation streamlines policy issuance and renewal. It also simplifies document generation and storage, making it easier for agents to access and manage policy documents. This not only saves time but also ensures that clients have quick access to their policy information when needed.

CRM automation is instrumental in organizing and managing client data. Automation tools can automate follow-ups and reminders, ensuring clients receive timely notifications about renewals, payments, or other important information. This level of proactive engagement can significantly enhance the client-agent relationship.

Claims processing automation is another critical component. It facilitates automated claims intake, making the claims process faster and more efficient. Additionally, it can assist in claims evaluation and settlement, improving the overall customer experience during the claims process.

Reporting and analytics automation provides insurance agencies with real-time performance metrics. It enables data-driven decision-making by offering insights into various aspects of the business, such as sales performance, customer retention, and market trends. This information is invaluable for shaping strategies and improving operations.

Challenges in Implementing Automation

While insurance agency automation offers numerous advantages, it has challenges. The initial cost and investment required can be a significant barrier. Implementing automation involves expenses related to acquiring software and technology, as well as costs associated with training and onboarding employees. Overcoming these initial costs can be a hurdle for some agencies.

Data security and privacy concerns are also a challenge. Insurance agencies handle a vast amount of sensitive customer information. Ensuring the protection of this data is not only a matter of compliance with data protection regulations but also a fundamental ethical obligation. Implementing robust data security measures and ensuring compliance can be complex and resource-intensive.

Employee resistance to change is another common challenge in automation adoption. Employees may be hesitant to embrace new technologies, fearing job displacement or the need to acquire new skills. Effective change management strategies, comprehensive staff training, and efforts to motivate and engage employees are essential to overcome this challenge.

Best Practices for Insurance Agency Automation

To ensure successful automation implementation, insurance agencies can follow these best practices:

Start with a clear strategy and goals: Align automation with your agency's business objectives and define specific KPIs to measure progress.

Choose the right technology and software: Evaluate available automation tools and select a solution that suits your agency's needs and budget.

Employee training and engagement: Invest in comprehensive training programs to equip your staff with the necessary skills to use automation tools effectively. Foster a culture of adaptation and innovation to encourage employee buy-in.

Future Trends in Insurance Agency Automation

The future of insurance agency automation is likely to involve several exciting trends, including:

Integration of AI and machine learning: These technologies can further enhance automation by enabling intelligent decision-making, predictive analytics, and personalized customer experiences.

Expansion of self-service portals: Self-service options for clients, such as online policy management and claims reporting, will become more prevalent, offering convenience and efficiency.

Improved data analytics and predictive modelling: Automation tools will become more sophisticated in analyzing data, allowing agencies to make more informed decisions and identify market trends.

Final Say

Automation offers a pathway to improved efficiency, enhanced customer service, and data accuracy. While challenges exist, the benefits of insurance agency automation are clear, as demonstrated by real-world case studies. By following best practices and keeping an eye on future trends, insurance agencies can stay ahead of the curve and harness the power of automation to achieve better results in this dynamic market. Embracing automation is not just a choice; it's necessary for insurance agencies looking to thrive in the digital age.

Start Automating with Wrk

Kickstart your automation journey with the Wrk all-in-one automation platform