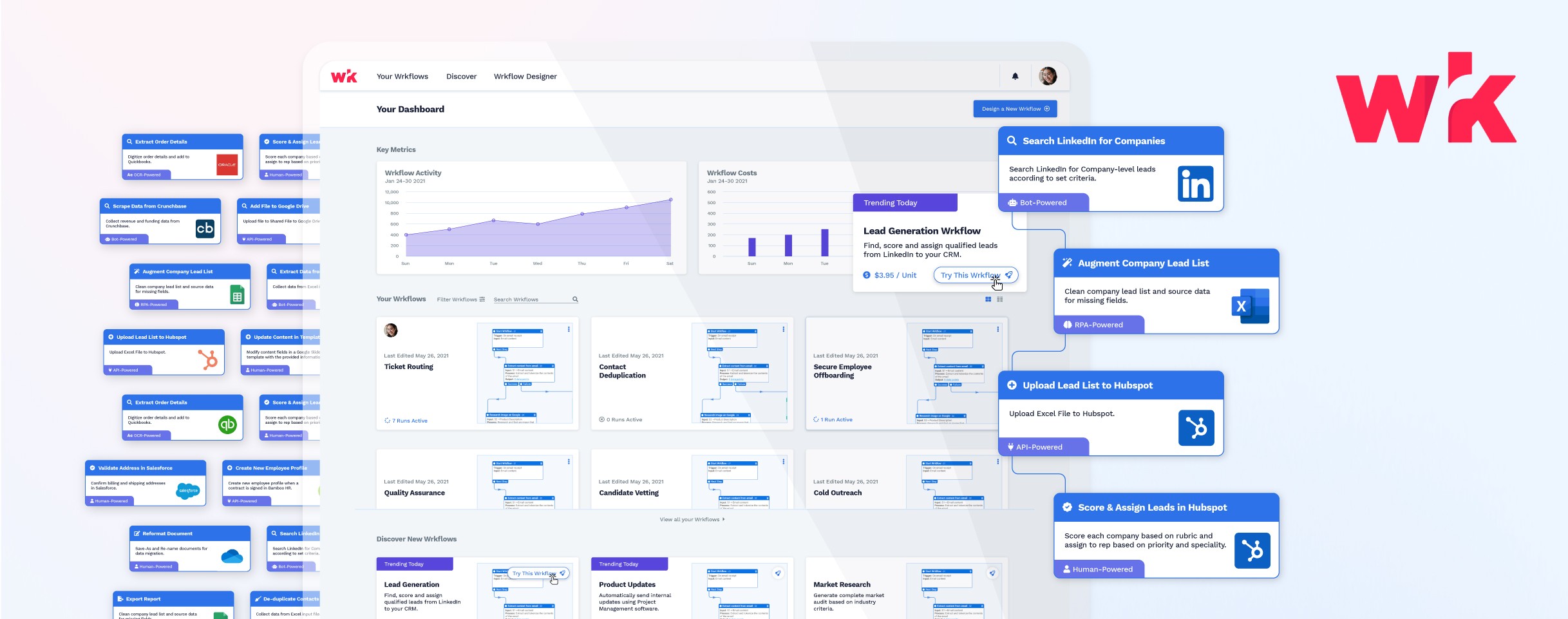

Efficiency and accuracy are at the core of effective financial operations. Wrk automates critical financial processes such as data entry, invoice processing, and reconciliation, minimizing manual errors and accelerating finance workflows. Seamless integration through Wrk’s APIs and connectors ensures consistent data flow across financial systems, reducing manual intervention and enabling faster, more reliable transaction processing. This is a key use case for finance workflow automation, especially for firms managing large volumes of financial data daily.

Navigating complex financial regulations requires precision and vigilance. Wrk automates compliance-related reporting, offering powerful financial reporting automation tools to ensure submissions are both timely and accurate. Built-in adherence to SOC 2 Type 2 standards and alignment with AML and KYC protocols safeguard sensitive financial data while minimizing compliance risks. This proactive approach simplifies regulatory processes and provides peace of mind in an evolving compliance landscape.

Proactive risk mitigation is vital for financial stability. Wrk’s finance automation solutions use robotic process automation to enable real-time monitoring and advanced data analysis to identify potential risks early. By automating alerts and responses, financial teams can act swiftly to address issues, reducing exposure and maintaining regulatory alignment. This continuous oversight helps organizations stay agile and resilient against evolving financial threats.

Delivering superior client experiences with streamlined onboarding, automated document processing, and personalized communication workflows is critical. Wrk’s Human-in-the-Loop (HITL) approach ensures that while finance automation handles routine tasks, human oversight maintains flexibility and quality for complex client interactions. This balance enhances client satisfaction, fosters stronger relationships, and accelerates service delivery.

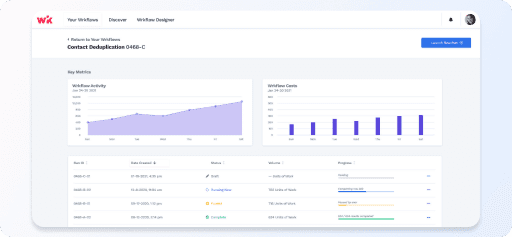

While critical, audit preparation and accurate reporting can be time-consuming and potentially error-prone. Wrk's platform delivers end-to-end financial reporting automation, including data collection, report generation, and cross-referencing, ensuring accuracy and reducing the time required for audits. Real-time data synchronization supports transparent reporting, enhancing credibility and simplifying the path to compliance. This level of precision and organization streamlines audits and promotes accountability across financial operations.

Efficiency and Speed

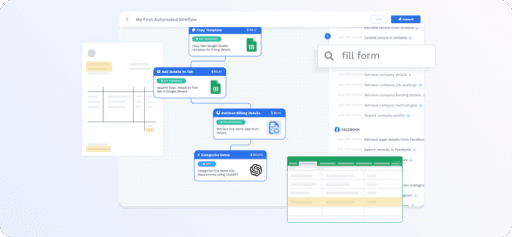

Wrk’s finance automation software doesn't just eliminate bottlenecks—it transforms how financial operations are managed. By automating repetitive and time-consuming financial tasks like data entry, invoice processing, and reconciliation, Wrk helps businesses accelerate their workflows. Financial data can be processed and shared in real-time, enabling faster decision-making, reducing operational delays, and ensuring clients receive responses quicker than ever before.

Accuracy and Compliance

Wrk’s automation solutions leverage real-time data integration and automated financial reporting to ensure accuracy at every stage. This minimizes human errors, ensures data consistency, and simplifies compliance with evolving regulations. Automated financial systems also keep track of regulatory updates, ensuring that reporting remains accurate and up-to-date, thus helping organizations avoid penalties and maintain strong relationships with compliance bodies.

Advanced Security

Wrk’s platform is SOC 2 Type 2 compliant, ensuring that sensitive financial data is safeguarded against breaches and unauthorized access. Automated financial processes reduce the risks associated with manual data handling, while compliance with the highest security standards provides peace of mind for clients and stakeholders. This means organizations can confidently automate finance processes while maintaining rigorous privacy and data security protocols.

Scales Effortlessly

Auto-scaling is second nature with Wrk. Our finance automation software automatically adjusts to increased volumes without compromising performance. As machine processes ramp up, we adapt licensing on the fly to get you the fastest and most cost-effective results. As your business grows, we’ll be there every step of the way.

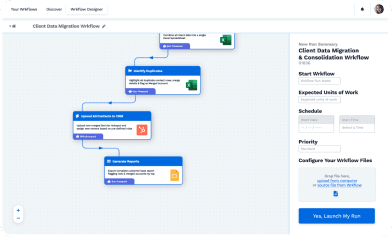

Launches in a Flash

See ROI within hours and days rather than weeks and months. With your team as our guide, we integrate all essential applications into our Wrkflows while setting employee-in-the-loop measures for what matters most. The result? A bull market for your firm.

Outcome-Based Pricing

You only pay for the finance automation you use. Wrk offers an outcome-based pricing model, meaning you pay just cents for every successful Wrkflow. We’re committed to delivering value from the get-go.

Web and Desktop Finance Automation

Automation can’t do everything. Our employee-in-the-loop hybrid approach lets your people focus on tasks that need human interaction. Leverage the power of technology with human oversight to ensure key decisions, whether they’re verification, approvals, or reporting, are accurate.

Looking Ahead: The Future of Finance Automation

How to Get Started

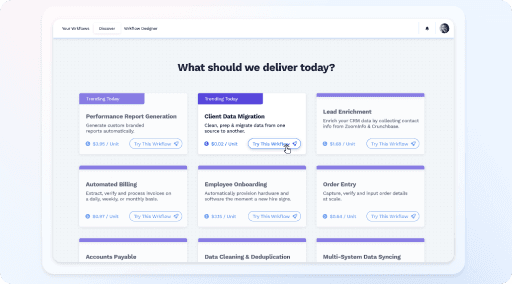

Wrk makes the journey to finance workflow automation straightforward and efficient.

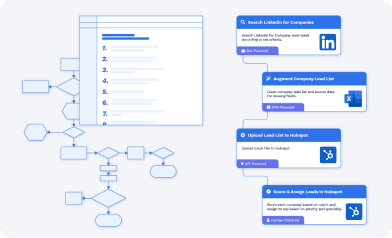

Consultation: We start with a comprehensive consultation to assess your current workflows, identify pain points, and outline finance automation opportunities.

Customized Strategy: Our experts develop a tailored finance automation strategy that aligns with your operational goals and compliance requirements.

Seamless Implementation: We handle the deployment of finance automation solutions, ensuring minimal disruption to your daily operations.

Ongoing Support: Operating on a managed-service model, our automation experts ensure continuous optimization and maintenance, keeping your finance automation solutions efficient and up-to-date.

“We partnered with Wrk to build a sophisticated Data Wrkflow, saving us hundreds of hours a week compared to the manual process, making Wrk an important part of our marketing plan.”

Nick Bhutani,

Cision

"Wrk has exceptional customer service and is very professional. Their expert team showcased the ability to adapt and grow as per our requirements. As a result, we have collaborated with them on six other Wrkflows because they are always willing to provide a quality automation solution, whenever required.”

Omar Awan,

Penny Appeal

“The Wrk Platform is bringing automation to anyone across any enterprise. With the intuitive logic of Wrkflows and their team’s expertise, there is no need to understand any tech jargon or to hire an army of consultants to bring automation to your team.”

Sanjay Zimmerman,

White Star Capital