Publish Date

2024-04-02

The insurance industry stands at the forefront of innovation, leveraging Artificial Intelligence (AI) to provide personalized consumer recommendations. Gone are the days of generic policies; instead, insurers are harnessing the power of AI to tailor insurance offerings to individual needs and preferences. This blog explores how AI is reshaping the insurance landscape, revolutionizing traditional approaches to policy recommendations, and enhancing customer satisfaction.

Understanding Personalized Insurance Recommendations

Understanding personalized insurance recommendations requires delving into how insurers leverage individual data to create tailored policies. Instead of relying on generic templates, personalized recommendations are crafted by analyzing various factors that define each individual's insurance needs.

Demographics play a crucial role in shaping personalized insurance recommendations. Age, gender, marital status, and occupation are just a few demographic variables that insurers consider. For instance, a young professional may require different coverage options than a retiree or a family with children. Insurers can tailor policies to address specific life stages and circumstances by understanding demographic nuances.

Behavioural data provides valuable insights into an individual's risk profile and preferences. This includes driving habits, lifestyle choices, and purchasing behaviour. For example, an individual who frequently engages in risky behaviours, such as speeding or smoking, may be deemed a higher risk and require different coverage options compared to someone with a healthier lifestyle.

Historical data, including past claims history and credit score, offers valuable predictive information for insurers. By analyzing historical data, insurers can assess the likelihood of future claims and adjust premiums accordingly. For instance, individuals with a history of filing frequent claims may be charged higher premiums to offset the perceived risk.

By considering these multifaceted factors, insurers can create personalized insurance recommendations that align with each customer's needs and preferences. Whether tailoring coverage limits, adjusting deductibles, or offering specialized endorsements, personalized recommendations empower individuals to choose insurance solutions that best suit their circumstances. Ultimately, personalized insurance recommendations depart from the one-size-fits-all approach, ushering in a new era of customized insurance solutions prioritizing individuality and relevance.

AI's Role in Insurance Recommendation

AI plays a pivotal role in driving personalized insurance recommendations. By analyzing vast amounts of data, AI algorithms can identify patterns, predict future outcomes, and assess risk more accurately than traditional methods. Machine learning algorithms, in particular, enable insurers to refine their recommendations over time, continuously improving the accuracy and relevance of their offerings.

Components of AI-driven Personalized Insurance Recommendations

AI-driven personalized insurance recommendations comprise several key components. Firstly, customer profiling involves gathering and analyzing data to understand individual preferences, behaviours, and risk profiles. This enables insurers to segment customers effectively and tailor recommendations accordingly. Secondly, risk assessment algorithms evaluate various factors to determine the likelihood of claims, allowing insurers to adjust premiums and coverage accordingly. Thirdly, tailored policy options ensure customers receive recommendations that align with their unique needs and preferences, maximizing satisfaction and retention. Additionally, dynamic pricing strategies enable insurers to adjust premiums in real time based on changing risk factors, providing fairer and more competitive pricing.

Challenges and Limitations

Despite its immense potential, AI-driven personalized insurance recommendations are not without challenges. Data privacy and security concerns loom as insurers navigate complex regulatory frameworks to safeguard sensitive customer information. Moreover, the accuracy and reliability of AI recommendations remain subject to scrutiny, with fears of algorithmic bias and fairness. Ethical considerations also come into play as insurers grapple with the moral implications of algorithmic decision-making and the potential for unintended consequences. Furthermore, regulatory compliance poses a significant hurdle, as insurers must ensure that their AI-driven systems adhere to strict legal and regulatory standards.

Future Trends and Innovations

Looking ahead, the future of personalized insurance recommendations with AI appears promising. Advancements in AI technology and the proliferation of data sources will enable insurers to offer even more tailored and customized solutions. Predictive analytics, in particular, will play a crucial role in identifying emerging risks and opportunities, allowing insurers to stay ahead of the curve. Furthermore, emerging technologies such as blockchain and Internet of Things (IoT) will further enhance the accuracy and relevance of personalized recommendations, enabling insurers to offer more innovative and value-added services.

Final Say

In conclusion, AI-driven personalized insurance recommendations represent a paradigm shift in the insurance industry, offering unprecedented customization and relevance. By harnessing the power of AI, insurers can offer tailored solutions that meet each customer's unique needs and preferences, driving higher levels of satisfaction and loyalty. While challenges remain, the potential benefits of AI-driven personalized insurance recommendations are clear, paving the way for a more customer-centric and efficient insurance industry. As insurers continue to embrace AI-driven solutions, the future of insurance looks brighter than ever.

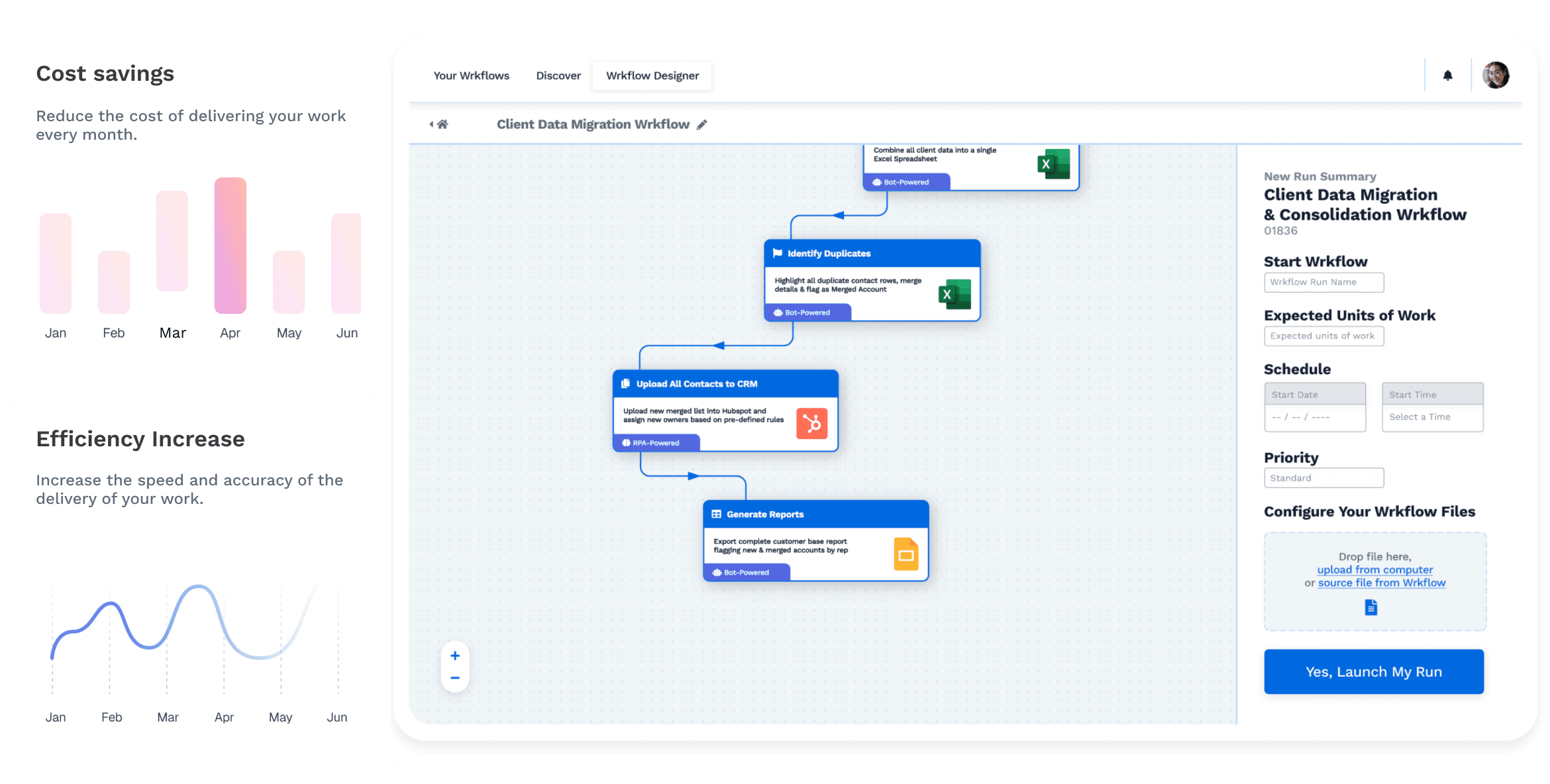

Start Automating with Wrk

Kickstart your automation journey with the Wrk all-in-one automation platform